There’s an easy way to explain customer churn: it’s when your customers stop buying from you.

Depending on the nature of your company, when a customer stops doing business with you, this can mean canceling their account or subscription, failing to renew a contract, or choosing a competitor for their new needs. With a recession looming, customer churn can be an even bigger nightmare than normal.

Customer churn is not good for your company. No matter how you look at it, if you want to grow your business, the number of new customers you bring on each month needs to exceed your churn rate. So, if you bring on new customers every month that grow your client list at a rate of 20%, but your churn rate is higher than 20%, then you’re likely burning money on expensive marketing acquisition channels that aren’t growing your business.

Right now, as our economy seems very uncertain, beating customer churn is an absolue must. We’ll dive into everything you need to know about customer churn and how you can prevent it.

What is Customer Churn Rate?

Customer churn rate is the percentage of customers lost during a certain period. The lower your customer churn rate, the better.

A low churn rate means customers are sticking with your brand. This means that you won’t need to spend as much time and energy trying to acquire and maintain new customers.

Your churn rate can also give you valuable business insights. It can help indicate if your customers are happy with your product or service, if you’re charging too much, or if there’s another reason customers are leaving your brand.

Why is Customer Churn Bad?

Customer churn is bad because it means you’re losing customers instead of keeping them. Granted, some customer churn is expected and even unavoidable. Some customers might no longer need your services, and others might not be able to afford the product anymore. And some might simply have changed their minds.

But too much customer churn – or churn for the wrong reasons – can be detrimental and costly to your business.

Here are a few reasons customer churn can be harmful:

- Fewer customers mean less revenue.

- Acquiring new customers is costly. It’s more cost-effective to keep your current customers.

- Unsatisfied customers won’t refer others to your business.

- Your product, service, or brand might not be meeting market demand.

How to Calculate Customer Churn Rate

You can calculate customer churn rate by taking the number of customers who left your business in a given period, dividing it by your total number of customers, then multiplying it by 100.

Customer Churn Rate Formula

Number of churned customers / total number of customers x 100

Example 1

If you were to lose 10 of your 100 customers in a given month, your customer churn rate would be 10%.

Example 2

Your company had 12,300 customers at the beginning of March. 1,100 customers left your business by the end of March. 1,100 divided by 12,300 multiplied by 100 equals an 8.94% churn rate.

Churn Rate and Attrition Rate

Before moving on, let’s address the elephant in the room. As we all know, there can be a lot of business and marketing terms out there that essentially describe the same thing. You may have heard churn rate and attribution rate thrown around interchangeably.

Like churn rate, attribution rate is also the number of customers lost over a period of time. Your attrition rate can be calculated in a few different ways:

- Total number of customers lost during a specific timeframe

- Percentage of customers lost during a specific timeframe

- Recurring business value lost

- Percentage of recurring value lost

Essentially, the terms mean the same thing.

Average Churn Rate By Industry

It can be hard to know what a good or bad rate of attrition is. If you want to remain competitive, it doesn’t hurt to know the average churn rate for your industry. You can always check your churn rate against the industry average to determine if you’re below or above the curve.

WordStream and Statista have gathered some online data on churn rates that will help give you a better idea of what you can expect in certain industries:

- Online retail – 22%

- Telecom companies – 21%

- General retail – 24%

- Financial – 25%

- Travel – 18%

- SaaS – 5-7%

Customer Churn Compared to Customer Retention

Customer churn is the percentage of customers who leave your brand, while customer retention is the percentage of customers who stay. Low churn and high retention rates tend to mean your customers are happy with your service. If you’re lucky enough to be in that position, congrats! It’s no easy feat.

By looking at your churn and retention rates over time, you can notice customer trends and make key adjustments. Why are people leaving your brand? At what point in the customer lifecycle are they leaving? Knowing these answers can lead to a stronger, more long-lasting period of business growth.

Maintaining stable churn and retention rates can also help you:

- Predict revenue

- Plan staffing levels

- Focus your strategic planning efforts

- Give your time and budget towards innovating

How to Prevent Customer Churn

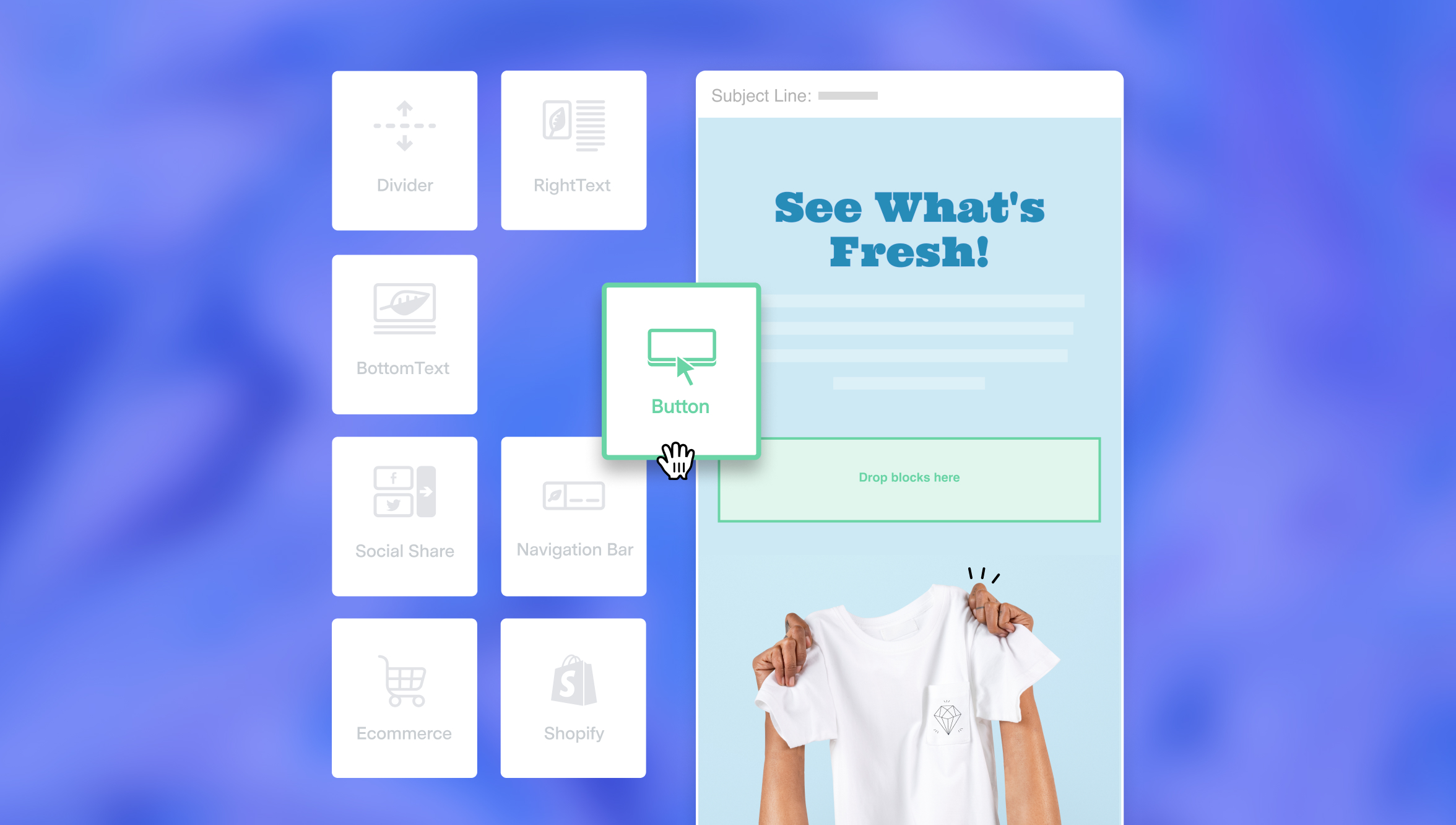

Since it’s important to keep your churn rate down, it’s also important to understand how to prevent churn. Thankfully churn can be prevented through some really easy strategies that your business can implement with little to no cost. Here are our favorite four ways to prevent customer churn:

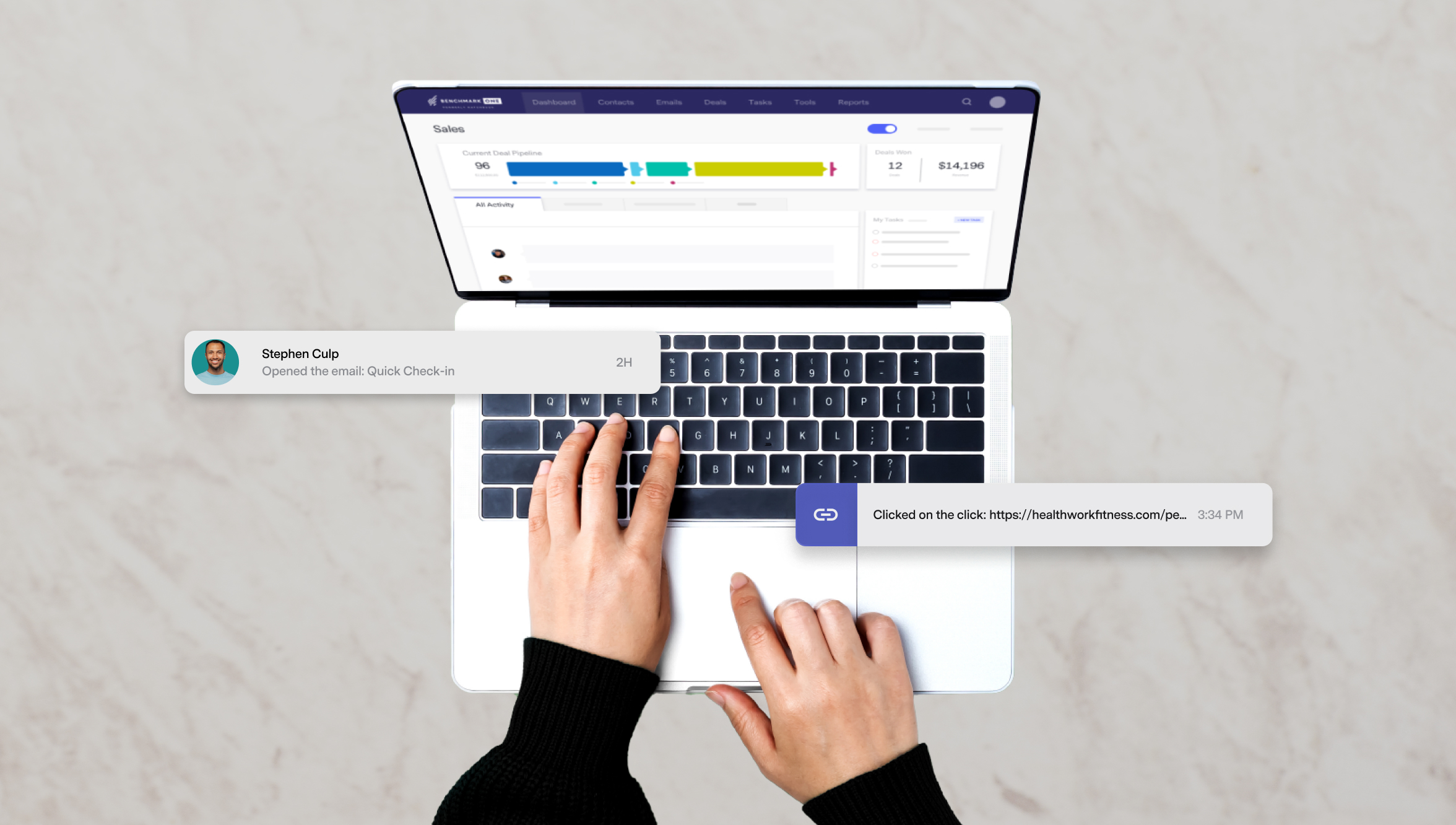

1. Talk to Your Customers About Why They Left

The best way to understand why your customers are churning is to talk to them. You can try sending a survey that might not get opened or responded to, or you can go straight to the source by calling your customers and having an honest, open conversation about why they left. The feedback might be harsh and hard to take, but at least you’ll get to the root of the problem.

2. Make A Great First Impression

Much like meeting someone in person for the first time, first impressions are everything. Follow your customer journey from the moment they find you online until the close of the sale and/or delivery of the product or service to ensure that there is a seamless, awesome experience throughout. If you follow the customer journey yourself and test it all the time, you’ll find the little bumps and iron them out before they affect too many customers.

3. Educate Your Customers Through Content

Create a ton of great educational content your customers can easily access that will help them with onboarding, training, and troubleshooting. If you continually ensure your customers are content and informed, they will be less likely to leave when they’re confused or when things go wrong. You can easily offer educational content in the form of free training webinars, product demos, FAQs, screencasts, and video tutorials.

4. Build an Omnichannel Customer Experience

Omnichannel customer experience is part of an excellent customer service strategy. You need to ensure that your business doesn’t just have a bunch of channels established that don’t have a cohesive brand story, message, or experience across all of them.

Since mobile phones are at our fingertips, customers regularly switch between using the phone, email, text, and social media. An omnichannel customer experience makes sure that your customers have a seamless, consistent experience across all channels and that a rep understands every conversation that happens across each. Repeating a problem to multiple reps is often a frustrating aspect of dealing with customer service departments, so it’s key to ensure all channels are represented with your customer service software and agents, keeping your whole service team on the same page.

5. Don’t Stop Nurturing After the Sale

It’s hard work to bring in new leads month after month. So, once those new leads become customers, it can feel like the work is done – but that’s not true. Staying top-of-mind with customers is just as valuable as staying top-of-mind with prospects. Marketing automation software can help you to continue relevant conversations with customers well after their initial purchase. Onboarding campaigns, cross-sell and upsell emails, and monthly check-ins can be easily automated and keep your customers coming back, whether to renew, solve a looming issue, upgrade, or make a new purchase.

By understanding your customer churn rate and how to lower it, you’ll be poised for business success. Utilize these tips to keep your customers around and prevent churn, and your customers will be more loyal to your business. Plus, you’ll be happy not to be spending unnecessary dollars acquiring new customers to urgently replace those who leave.